The work Practical Action does to enable individuals and communities around the world to improve their lives and future prospects and those of their children is both essential and truly inspiring. Such support will be needed for many years hence my decision to remember Practical Action in my Will.

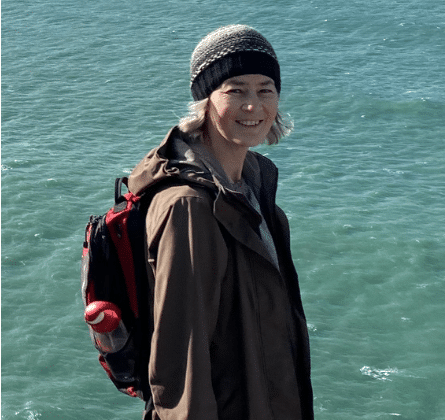

Janice, Practical Action supporter