The intervention use case is where the rubber meets the road with PMSD. As project staff interact with a wide range of market actors, they start to influence the way the market system operates.

Who is this guidance for?

- Senior PMSD experts

- Project managers

- Project staff

Because of PMSD’s emphasis on facilitation and participation, it can be hard to predict what facilitative activities will be effective in advance. Creating space for learning and adaptation is crucial to success in interventions so that change can be owned by local market actors, and so the project doesn’t end up becoming the centre of attention. This requires humility and a recognition that we are not in control.

Equally important is the skill and capacity of individual facilitators, and teams of facilitators. It is recommended that any project staff engaging directly with market actors should have access to training and mentoring support – both from managers within the project and the broader pool of PMSD advisors. Reading through this use case, and the associated tools, is a good starting point. There are also resources available for self-assessment of facilitator skills and capacities, and for self-directed learning to improve on particular competencies for market systems development. Finally, participation in internal learning (such as Practical Action’s markets community of practice) can help answer questions, and get input on challenges faced with the pragmatic realities of facilitation in the field.

Different projects have different degrees of flexibility and control over their activities. Ideally, PMSD projects will have explicit permission and autonomy to undertake a range of facilitation activities that are adapted to the local context and responsive to market actors. However, a reality is that many will have significant parts of the project design (and budgeted activities) prescribed, and only a small portion of the project might be earmarked for facilitation or participation. This use case has been written to support both types of projects. However, the main guidance emphasises how to facilitate interventions within a project level framework for market system-level change.

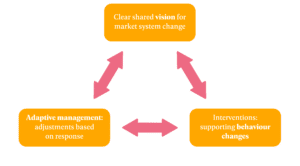

The use case is organised around three related parts. First, establishing a clear shared vision for change in the market system that is understood by the market actors themselves and by project staff. This vision should be grounded in market analysis, but it does not need to be overly complicated. Second, individual interventions need to be organised around targeted behaviour changes by individual (or small groups) of market actors. It’s important that each intervention has a clear set of behaviour changes associated with it, which themselves have clear links to the wider systems change. Finally, the third part is about paying attention to what actions market actors actually take – and adjusting support and facilitation activities accordingly. Where things aren’t moving, this can mean putting partners on hold to work with people with more energy or commitment. Where things are progressing quickly, this can involve shifting focus from individual early adopters to spreading a behaviour to a much wider group through strategic communication and sharing of information.

Part 1: A clear shared vision for market system change

It is assumed that prior to facilitating interventions, some level of market system analysis has been completed. Developing a vision for a future functioning of the market system is crucial as it provides a clear direction and realistic expectations of what we are aiming for. At the core of a strong vision is how a market system will operate without continued support. Even more important is to have buy-in from the market actors themselves to want to move towards that vision.

For projects with sufficient resources, Participatory Market Mapping is the flagship intervention for kicking off PMSD processes with market actors. By bringing together a diverse cross-section of the actors in the market system, including representatives of marginalised groups, it is possible to build a picture of the current market system through the market map. Often, this will be the first time market actors themselves think about the full picture of relationships and connections – beyond their immediate partners and activities. It’s important to emphasise that this activity is an intervention! It leads to the development of relationships, including a strengthened voice for marginalised groups, which can influence how the market operates in the future. Both the project and the participants will learn a lot about the different perceptions people hold, and where there is high or low consensus on the critical systemic blockages and opportunities.

It may take several meetings before the group is capable of articulating alternative future scenarios for how the market system could function in the future. Also, it is likely that not every key actor will be in agreement about the need to change in the same direction. Therefore, it is important as a project team to think about strategies for engaging individual actors and smaller sub-groups as follow-ups to Participatory Market Mapping in order to generate momentum towards a vision of future system performance.

For projects with limited resources for PMSD, the vision may be highly specific to one particular issue or constraint within a market system. Even if there are limited resources for more in-depth analysis of the wider systemic issues, it is useful to articulate the vision: how do we want to see the market system function in the future, without our support?

Ultimately, the vision is a hypothesis of how change may unfold – not a fixed plan to stick to rigidly. It can be presented in a few different formats or visualisations:

- A ‘future’ vision of a market map – highlighting in one colour the new actors, new services/products, or new relationships. This helps to contrast the current market map with what will be different in the future. It also helps market actors place themselves within the market system.

- Who does, who pays matrix – a table listing which actors perform key functions, and which actors pay for those functions/services. This is helpful for ensuring financial sustainability – i.e. that the market system can continue without project support.

- A broader statement/direction – sometimes it is useful to have an even broader vision (e.g. improved engagement of smallholder farmers in horticultural markets through improved supply chain management by key firms) that gives direction but leaves more room for experimentation on how to get there through a diverse set of partnerships.

Part 2: Interventions supporting behaviour change

Bringing the vision into reality requires market actors themselves changing their behaviour in ways that align with the new desired norms of the market system. This is an ongoing activity that should be running continuously throughout a project’s life. However, it can be helpful to break this down into three phases:

- Prioritising which market actors to meet and approach;

- Presenting a compelling ‘offer’ to market actors (i.e. convincing them to change their behaviour; and

- Structuring and delivering the minimum necessary support to see that behaviour change succeed without depending on us indefinitely.

There may not be clean, distinct transitions – and in some cases all phases may take place during a participatory market mapping workshop.

Phase 1: Prioritising market actors

There are several tools which can help to prioritise which market actors to approach to develop interventions. A few key tools are summarized below:

- Will-Skill Matrix: What are the capacities and motivations of different market actors? Which are likely to lead change? Resist change?

- Influence-Relevance Matrix: Which market actors have the most power/influence to effect change? Which are most relevant to the market system?

Both of these tools can be used at different points in the process: they may in fact be used earlier on to identify who should be involved in participatory market mapping. Your sense of where actors are placed on these different dimensions (i.e. their motivation or will; or their influence/power) may also change through interactions and experiences with them.

Phase 2: Approaching market actors with a compelling ‘offer’

Actually setting up meetings with market actors to propose working with them can be a daunting task for project staff who haven’t had much experience with private sector development. This is an extremely important entry point and so it can be worthwhile practicing or role-playing interactions in advance, with a peer or a coach. The most important point is to focus the meeting’s attention on the strategies, interests and future of the market actor themselves, and to downplay the project’s role, resources and interests. Treating every interaction as a strategic planning process – for how the market actor can meet their goal and play a role in changing the market system – is a powerful stance.

Two tools that can help provide some structure to this ‘offer’ are the Business Model Canvas – which can help provide a structure for focusing on how the business itself operates; and Self Selection’s ‘Relationship, Ownership and Intensity’ model, which keeps facilitators focused on market actor behaviours. They are elaborated below:

Tool |

Description |

Insights Generated |

|---|---|---|

| Business Model Canvas | Tool to analyse different components of a business in a simple diagram. Can be used to guide strategic planning by an individual firm, or to brainstorm ideas for new/changed business models. |

|

| Self Selection | Strategy for continually checking that market actors are committing time and resources to change. When they stop showing commitment, the project also steps back. This builds ownership. |

|

Developing a strong offer requires that facilitators: (1) listen carefully to market actors and their concerns; (2) are aware of the full range of activities they could undertake; and (3) stay patient and calm until the opportunity to present ideas is right. Often the factor that leads to unsustainable activities (i.e. significant financial support for an activity the market actor could pay for themselves) is a lack of knowledge of the alternatives. Here, an excellent resource is the Facilitation Tactics and Activities, which helps a facilitator think about what might be required to convince a market actor to change their behaviour, and what can be done to nudge them in that direction.

Ultimately, there is no perfect way to approach a market actor. Often it will take several meetings – some 1-on-1, some in group format – to build the mutual understanding and trust to get the actor to commit to some sort of change. Learning from engagement in participatory market mapping exercises can be particularly powerful – as new ideas about how the wider market system works, and what other players are willing to try may be useful forms of peer influence to convince a particular actor to try something new.

Phase 3 – structuring and delivering support to actors

Assuming you have obtained some level of agreement from a market actor to try something new, it is now the time to document and formalise that commitment. It’s important to remember at this stage that many of the best facilitative activities do not require any resources from the project! As shown in the Facilitation Tactics and Activities, only a minority of the forms of support require financial support or subsidy! In fact, one of the most common facilitative tactics is to present market actors with a clear Business Case that stimulates them to pick up the activity.

Regardless, it is useful to have a clear approach for documenting meetings and tracking the targeted behaviour changes. The Firm Level Improvement Plan is an excellent starting point. It simply tracks, for each market actor, the broader behaviour change, specific strategies and reasons why that can benefit the firm. It then forms an internal learning tool for project staff to try different activities and document the response. In certain cases, it can also be used as a shared strategic planning tool with the firm to bring to each meeting.

For a more robust approach to documenting a support agreement, especially when any financial support is committed by the project, it is necessary to develop a Partnership Agreement. There are different formats depending on the size of the partnership, and the level of sophistication of the firm’s own accounting and management systems. Ultimately, what a Partnership Agreement should accomplish is:

- A clear picture of who is doing what (partner and firm) and why;

- Timelines for checking progress, and consequences if the market actor does not follow through. (Note: the important message is that we are there to support as long as they are committed; they can change their mind at any time – but then our support will also be put on pause until they are ‘serious’ and ready to move forward);

- Where financial support is offered, the market actor themselves should always be contributing an equal or greater share of financial resources to ensure they have skin in the game. Additionally, there should always be a projection or calculation of how, following a bounded period of support (based on time or number of transactions), the partner can continue funding the activity/behaviour without any external support.

Part 3: Adaptive management – adjusting based on response

The vast majority of project time and effort will be spent in this third part of facilitating interventions: adaptive management. There is enormous uncertainty and ambiguity in the actual steps the market actors themselves take, the results they have, and what they decide to do long-term. And yet it is in this uncertainty that the promise of sustainability lies – when market actors have a compelling reason to change, with the right capacities in place, and they experience even some of the intended benefits, their likelihood of continuing (with adjustments) is greatly improved. So how do we plan for this uncertainty?

The simplest answer is to build strong routines within the project team. At least three sets of regular meetings, with enough structure to give each a clear purpose, can make a big difference to staying on top of things:

- Regular bi-weekly meetings with market actors: to track progress, offer coaching, and jointly problem-solve issues;

- Regular weekly meetings with field-level colleagues and Monitoring and Evaluation (M&E) staff: to share learnings and observations, triangulate findings, and update firm-level improvement plans;

- Quarterly project-level reflection and review meetings: to draw on monitoring data to challenge facilitator perspectives, decide on which partnerships to drop, add or change, and to chart progress towards market system level visions. In these meetings results chains should be reviewed and updated.

In the longer-term, over a period of several years, it is useful to have a framework for thinking about when it is time to change strategic direction. A common framework for managing and measuring systemic change is the Adopt, Adapt, Expand Respond (AAER) framework. This differentiates simply between work with (a) direct market actor partners and (b) indirect market actors.

With direct partners, we look to see evidence that actors Adopt new behaviour and practice changes (demonstrating buy-in and commitment) and later Adapt these behaviours without any support from the project, further showing the value and sustainability of those new practices. This can often take place over a timeframe of several years, although it depends enormously on the complexity of the change. For an agricultural market system, it would easily require at least two farming cycles to see realistic evidence of Adoption, and probably three to four cropping cycles to see Adaptation. So for rain-fed agricultural systems, that might be up to 4 years for Adoption. In contrast, a multiple-season year, especially with irrigation, operates on much shorter timeframes.

With indirect market actors, the idea of AAER is to look for evidence that the practices have Expanded to new actors without any of the individual support or advice that the original adopters had. This is also sometimes called “crowding in” within market systems projects. The reality is that it rarely happens organically, and so part of moving towards a market system change is to make a conscious decision to decrease support to initial partners (as they start demonstrating Adoption and Adaptation) in order to spread information about the innovation to a much wider group. This is a conscious change in strategy that requires new forms of expertise (i.e. behaviour change, communications/media and influence tactics) as it becomes important to know what information to convey, in what formats, through what media channels to actually influence businesses. Is it through radio interviews with adopters? Or through trade fairs? Is it useful to show political support from government, or more influential to have ideas spread through informal word-of-mouth?

Another perspective on the sequence of strategies for realising systemic change comes from the SelfSelection tool. Following a slightly different framework than AAER, the Self Selection tool shows how project priorities should shift as the phase of systemic change evolves, the stages are as follows:

- Initiate Change;

- Early Adoption;

- Early Adaptation;

- Reinforcing system change through interconnected systems;

- Alignment of systemic feedback creating new biases;

- Change rooted in system.

This presents a complementary approach to AAER, as it emphasises the fact that as any change starts to build momentum and take root, it is at this stage that the system pushes back through feedback. This is where the loops from the Causal Loop Diagram can be seen in effect – either reinforcing the new change, or pushing back against it, depending on the system’s structure. The development of causal loops earlier on in the process can allow you to anticipate this sort of feedback, and is a powerful strategic tool for advanced projects in the later years of implementation.

Finally, it is important to recognise that adaptive management depends on a consistent flow of quality information. This use case has emphasised the use of information from direct interactions of project field staff with market actors through meetings and observations. Another crucial source of information comes from a project’s Monitoring, Evaluation and Learning (MEL) system. In an ideal scenario, the MEL officer and/or manager have been engaged and brought along to understand the objectives and process of PMSD. In this way, they can play a key role in helping project staff articulate and map out their assumptions of how behaviour changes by individual actors can add up to a larger market system change that ultimately benefits marginalised groups. The role of Monitoring in PMSD is explored in more detail in the Monitoring Systems Change use case.