Frequently Asked Questions

How do small donations make a difference?

We believe that big change starts small. All the donations we receive, no matter their size, enable us to continue putting ingenious ideas to work finding solutions to some of the worlds toughest problems. So every donation really does make a difference. And if you can Gift Aid your donation, it adds 25% without costing you a penny.

Why should I make regular gifts?

In short, it means we can predict our income and plan more long-term projects. But it also means you can give a smaller amount on a regular basis, doing more good over time. Plus, a regular direct debit is the most cost-effective way to donate.

What is Gift Aid?

Gift Aid is a free and simple way for UK tax payers to increase their donation by 25%. As Practical Action can reclaim the basic tax rate (25%) on your gift. To do this you’ll need to sign a Gift Aid Declaration for the government to release the tax to us.

Please see our Gift Aid page to find out more.

What if I’ve agreed to Gift Aid to another charity?

Don’t worry. You can support as many charities as you like. As long as you return a Gift Aid declaration to each charity you support, and make sure you’re paying enough tax each year to cover all your donations.

Can I use Charities Aid Foundation vouchers to make Gift Aid donations?

The tax has already been reclaimed on Charities Aid Foundation vouchers. But by filling in a Gift Aid form we’ll be able to claim for any donations you make to us directly.

How can I give tax directly from my salary efficiently?

You can join Give As You Earn. If your pay or pension is taxed through PAYE and your employer is part of the scheme you can make regular donations from your salary before tax. Go to ‘CAF Give As You Earn’ for more details.

Can I make a donation in lieu of a celebration?

Of course. Choosing to support our work instead of receiving gifts is a really special way to celebrate your occasion. There are a few different ways to do this:

- Send a cheque by post payable to Practical Action

- Ask your friends/family to call our freephone number 0800 389 1624 to donate by credit/debit card specifying that the donations are for your celebration.

Can I donate directly from my payroll?

Yes, you can. Just choose a donation amount, which is deducted from your monthly pay packet, before tax. Because it’s taken before tax, the amount you pledge actually costs you less!

Can I donate shares to Practical Action?

Yes. By donating your shares to Practical Action not only will you help in alleviating poverty, you can also reclaim the tax on your gift. There are two ways to do this depending on whether you want the charity or you to get the most benefit.

Can I leave a legacy to Practical Action?

Yes. Legacies are vital to our work because they help us plan ahead.

Does my donation go directly to the appeal?

If there is a specific place or project you’d like your money to go to, please contact us to let us know and we can assign it

for you.

Where is my money being spent?

We’ll spend your donation where it can do the most good. Unless you have requested a specific programme.

How do you ensure that my money is spent properly overseas?

We have a rigorous system of monitoring to support our country offices and projects. We also have internal audit functions and external audits carried out by independent accountants.

Still have questions?

Contact our Supporter Care team via email [email protected] or by Telephone +44 (0)1926 634485

An organisation you can trust

We’re committed to the highest standards in fundraising, transparency and reporting.

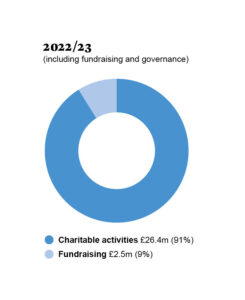

For every £1 we receive in donations, just 9 pence is spent on fundraising. The remaining 91% is spent on charitable activities around the world.

(2022/23 audited accounts, produced to Charity Commission norms).

We are trusted by the UK and overseas governments who fund some of our projects, along with major foundations, corporations and UN bodies.

Practical Action is registered with the Fundraising Regulator and the Fundraising Preference Service

Read our Supporter Promise, Privacy Policy and Transparency Policy